A Top 15 U.S. Bank Saves Time and Money by Going Digital

- 5 minutes read

Today's banks and other financial institutions worldwide face a variety of challenges, including pressure to reduce costs, improve return on equity, adjust to technological advancements, and enhance operational efficiency. Legacy processes at many traditional financial institutions exacerbate these challenges. Specifically, processing audit confirmations and commercial credit inquiry requests is unnecessarily inefficient, relying on paper and other outdated technologies to manage millions of dollars in assets and balances around the globe. However, tools available to today's banks and other financial institutions can save enormous amounts of time and money, helping firms to respond favorably to investor and shareholder pressure, and yield increasingly positive results.

Challenge: Operating inefficiencies waste time and money

Each year, auditors and credit managers send millions of audit confirmation letters and commercial credit inquiries to verify clients' balances and arrangements. As responding entities, financial institutions receive an overwhelming number of requests by mail, fax, and email. These inefficient communication channels hinder a financial institution's ability to successfully execute audit engagements by increasing risk and decreasing productivity. A current Confirmation client - one of the United States' largest financial institutions - reported total assets over $200 billion USD in 2017. But before they implemented Confirmation, the human and capital costs of processing over 30,000 confirmation requests annually proved detrimental to their ability to operate efficiently.

Opportunity: Digital workflows increase efficiency, save time and money

In 2007, this bank began the transition to an online audit confirmation process by engaging with Confirmation. The service exposed significant inefficiencies in their workflows, and by 2009 the bank had decided to respond to confirmation requests exclusively through Confirmation. With a modern, digital process in place, this bank began to realize significant benefits:

- Defined workflows that eliminate human errors and redundant data capture

- Time savings of up to 90 percent, substantially reducing processing costs

- Real-time data visibility with extensive reporting capabilities

- Secure control environment that protects clients’ data and combats fraud

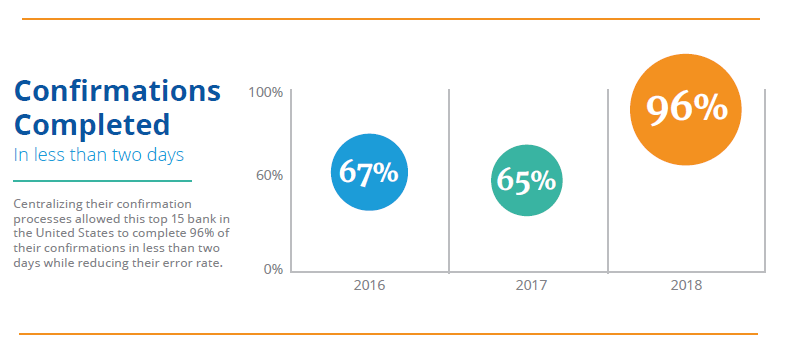

After realizing the benefits of using Confirmation for its audit requests and responses, they looked for ways in which it could impact other areas of the business. In 2016, the bank decided to expand its use of the platform by accepting commercial credit inquiry requests through Confirmation. With the addition of credit verification, the financial institution recognized an opportunity to further streamline its workflows and reduce costs by centralizing all audit confirmations and commercial credit inquiries within one department. Today, a team of four people, led by a QPM Specialist, processes all account verifications from one office in Nashville, Tennessee. "As is common when banks are consolidating, if a group of people or department is doing what they do well and has capacity to do more, the bank will adjust as necessary," says the specialist.

Implementation: Centralizing the process

Before centralizing their confirmation workflows, understanding the true cost of these processes was impossible. With a centralized process using Confirmation, the financial institution's managers and executives could quickly identify the amount of time and money spent responding to requests. As the team lead, the QPM specialist can generate reports to view pending and completed confirmations, and identify productivity increases on both an individual and departmental level.

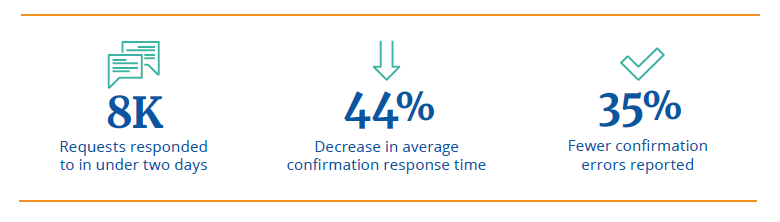

During the first quarter of 2018, the bank processed 96.25 percent of its requests in less than two days, a YOY increase of 30 percent. Additionally, the average response time between request and response decreased by 44 percent from 37.5 hours to 21 hours. "Confirmation is easy to use," says the QPM specialist. "The detail of reporting really stands out and is very beneficial."

Results: Lower costs, enhanced client experience

At the beginning of audit's busy season each year, there are thousands confirmation requests in their queue. In order to effectively manage resources and timelines, it's imperative for the bank to have a simple, standardized, and secure workflow in place. In January 2018 - the peak of audit season in the U.S. - this financial institution responded to 5,556 requests in less than one day and nearly 8,000 in less than two days. "Before Confirmation, if we had received 8,000 paper requests during audit season, we'd still be doing them nine months later," says the specialist. "Clients are very happy with the speed and accuracy."

Confirmation also helped reduce operational and human errors, which led to a significant increase in employee productivity. By responding to requests exclusively through Confirmation, this top 15 bank in the U.S. reported an error rate of less than 5 percent, eliminating the need for a costly reconfirmation. Banks that have not implemented a consistent workflow around Confirmation have an average error rate of 20 percent, and those responding to paper-based confirmations experience an error rate of 40 percent or higher. The efficiencies gained from the use of Confirmation enables them to identify and respond to requests quickly and efficiently, reducing costs not only for the bank but also its clients.

Key Takeaways

- Banks that use Confirmation to centralize their workflows can reduce processing time by up to 90 percent

- Confirmation provides easily accessible data and reporting capabilities so users, managers, and executives can gain insight into friction points and opportunities

- Efficient processes and fewer errors save money, leading to satisfied clients and greater return for shareholders and investors